The CIT funds capital improvement projects throughout Hillsborough County

The Community Investment Tax (CIT) is a half-percent sales tax that was approved by Hillsborough County voters in September 1996 for a period of 30 years. It expires Nov. 30, 2026. Hillsborough County voters voted to renew the tax through Dec. 31, 2041. The renewal ballot language, which was approved Nov. 5, 2024, read, "Shall Hillsborough County renew the existing local government infrastructure surtax, known locally as the community investment half-cent sales tax, commencing December 1, 2026, through December 31, 2041, to be shared with the municipalities and the School Board to fund infrastructure for transportation and public works, public safety, public facilities, public utilities and public schools."

The sales tax was established to fund capital improvement projects and capital equipment in Hillsborough County and the cities of Plant City, Tampa, and Temple Terrace. Capital improvement projects include construction as well as renovation, replacement, and expansion projects of existing facilities or assets, often referred to as infrastructure. Capital equipment is typically large equipment such as fire rescue and police vehicles.

Hillsborough County CIT Renewal

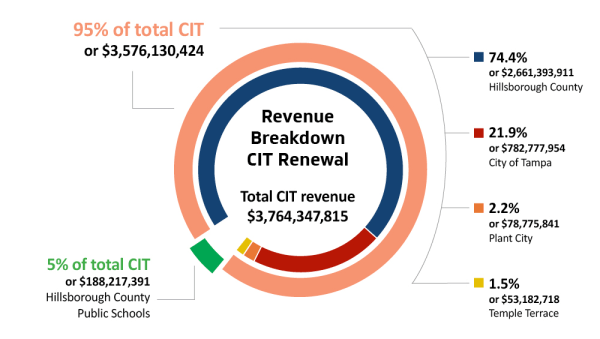

The renewed half-cent sales tax will continue as part of the current 7.5% sales tax paid by residents and visitors to Hillsborough County. Starting in December 2026, Hillsborough County Public Schools will receive 5% of the total CIT revenue. The remaining revenue will be distributed to Hillsborough County and the three cities per the population-based State-Shared Half-Cent Sales Tax Formula as illustrated in the CIT Revenue Breakdown chart.

Planned Project Lists for the 2026-2041 CIT

- Hillsborough County

- City of Plant City

- City of Tampa

- City of Temple Terrace

- Hillsborough County Public Schools

Financial Impact Statement Committee on CIT Renewal

CIT in action

Map Viewer of CIT Projects 1996-Present

Over the past 28 years since the tax was approved by the voters, it has provided about $2.77 billion to fund or partially fund 784 capital improvement projects. These include:

- 24 fire station projects

- 115 road projects

- 273 parks and recreation projects

- 29 law enforcement and courts projects

- 70 intersection projects

- 32 bridge projects

- 126 stormwater projects

- 42 public utilities projects

- 13 sidewalk projects

- six new or expanded libraries

- 42 government facilities projects

- 12 arts and culture projects

The CIT also made possible the construction of Raymond James Stadium, a facility owned by Hillsborough County.

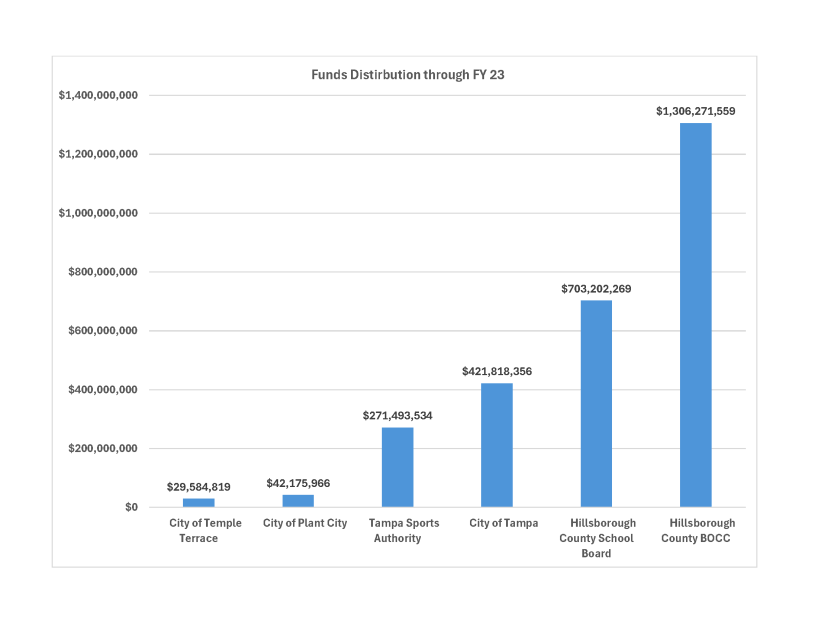

Current funds distribution

Under the current CIT distribution the Hillsborough County School Board receives 25% of CIT revenue, and the Tampa Sports Authority, which manages the stadium for the County, receives about $9 million annually for stadium debt service. The remaining revenue is distributed to the Hillsborough County Board of County Commissioners (BOCC) and the three cities per the population-based State-Shared Half-Cent Sales Tax Formula. In 2024, the BOCC received 74.4% of the remaining revenue, while Tampa received 21.9%; Plant City received 2.2%; and Temple Terrace received 1.5%.

A brief history

In the early 1990s, local governments faced a backlog of unfunded capital projects that were needed to support the community’s rapid growth. Unincorporated Hillsborough County alone had nearly $1 billion in unfunded capital needs. A CIT proposal was jointly developed to divide a new half-percent sales tax among Hillsborough County, the cities, and the school district. The proposal detailed what taxpayers would get for their money, including transportation, parks, schools, water, wastewater and reclaimed water projects, and law enforcement and fire rescue equipment and facilities.

For added transparency, local governments presented voters a list of projects that would be covered by the CIT in its first five years.

The 1996 CIT ballot referendum passed with 53% of the vote. The ballot language read: “Shall Hillsborough County levy a half-cent sales tax for thirty years to be shared with the municipalities and the School Board to finance infrastructure for jails, police and Sheriff's equipment, fire stations, emergency vehicles, school construction, a community stadium, transportation improvements, libraries, parks, trails, stormwater improvements and public facilities.”

Documents

Surtax Performance Audit

Florida Statutes require the Office of Program Policy Analysis and Government Accountability (OPPAGA) to oversee a performance audit of local governments with an upcoming referendum on the discretionary sales surtax. The audit must be conducted at least 60 days before the referendum is held. View the 2024 Surtax Performance Audit.